- Homepage

- Campus Initiatives

- Climate Action

- Neutral UF Coalition

- Carbon-Neutral Commuter

Carbon-Neutral Commuter

Employee commuting makes up about 6% of UF’s total carbon footprint. For most employees at the University of Florida, driving is a necessity. Although we work to promote alternative transportation options whenever possible, we realize and understand that it is not realistic for everyone. Those employees may enroll in voluntary post-tax payroll deductions to offset their commute. Just one dollar per pay period – or $26 a year for 12-month employees – can completely offset the average UF commute (~9 miles).

Offsets are a way to invest in actions that reduce climate impacts in one location to make up for (offset) emissions that cannot be avoided in another location. These offsets are created through our local non-profit offset partner, We Are Neutral. 100% of the voluntary deduction amount goes to create these offsets, which fund tree plantings on local conservation land, as well as provide energy retrofits in low-income housing in the local community.

Voluntary deductions can be started or stopped at any time, and you may change your enrollment whenever you like.

Ready to to make your work commute carbon-neutral?

Great! Follow the easy steps below to become the newest member of the Neutral UF Coalition!

Step 1: Login to myUFL

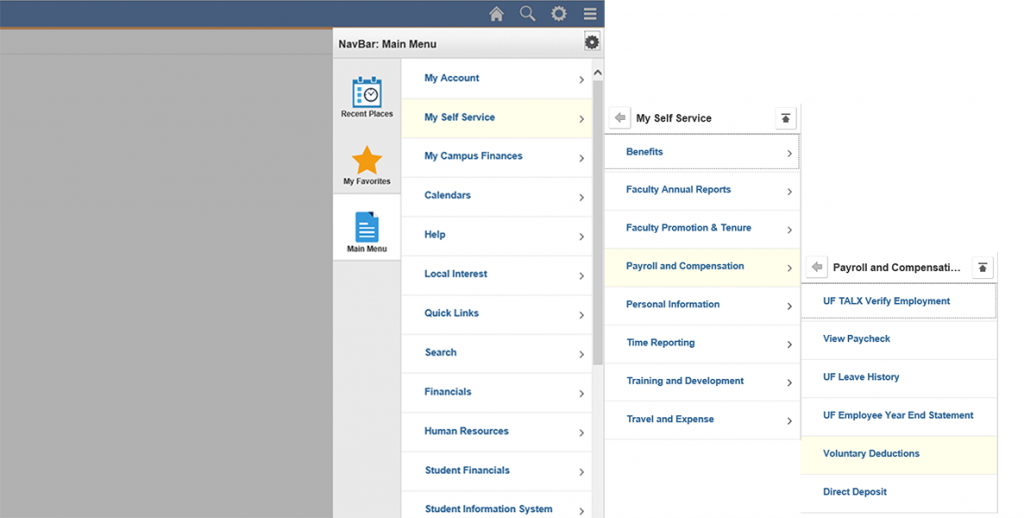

Step 2: Navigate to Voluntary Deductions section

- Click Main Menu –> My Self Service –> Payroll and Compensation –> Voluntary Deductions

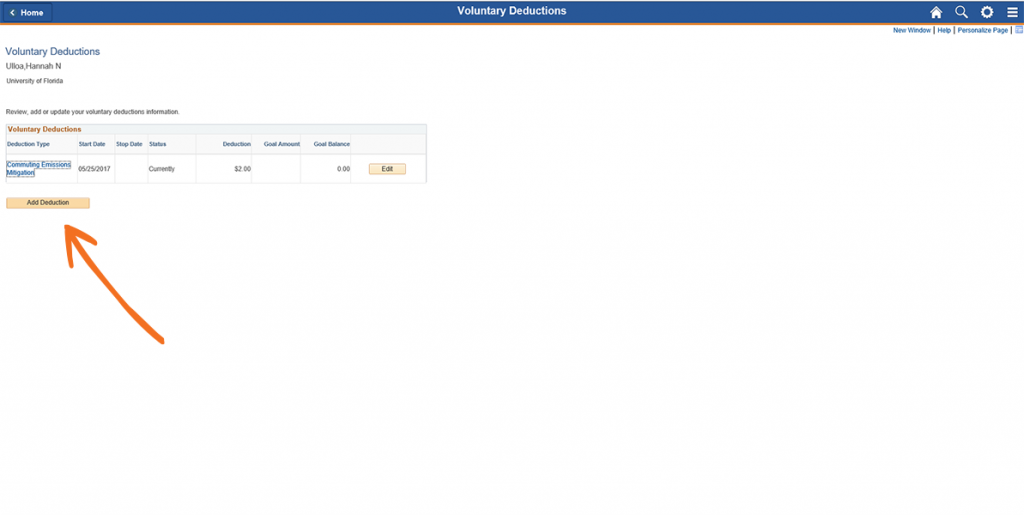

Step 3: Add a new deduction

- Click the yellow “Add Deduction” button

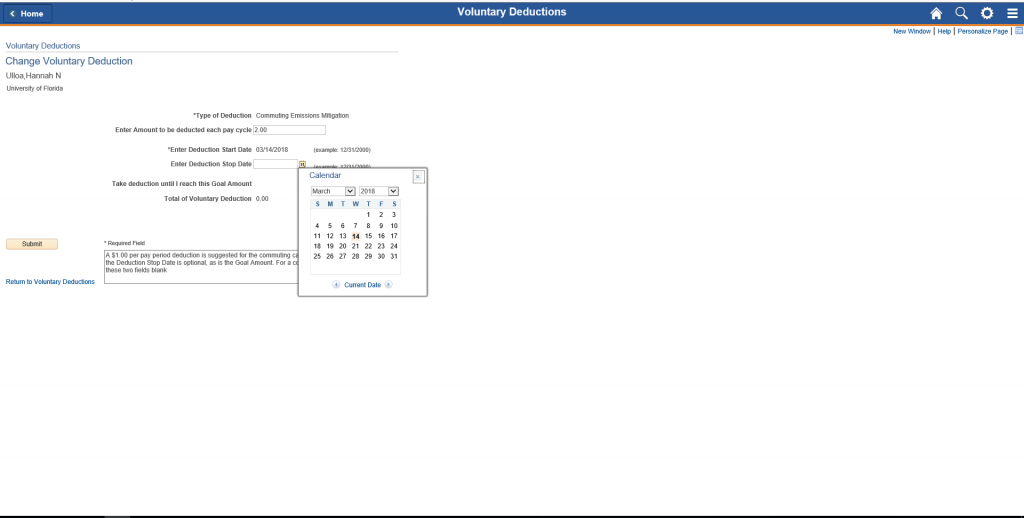

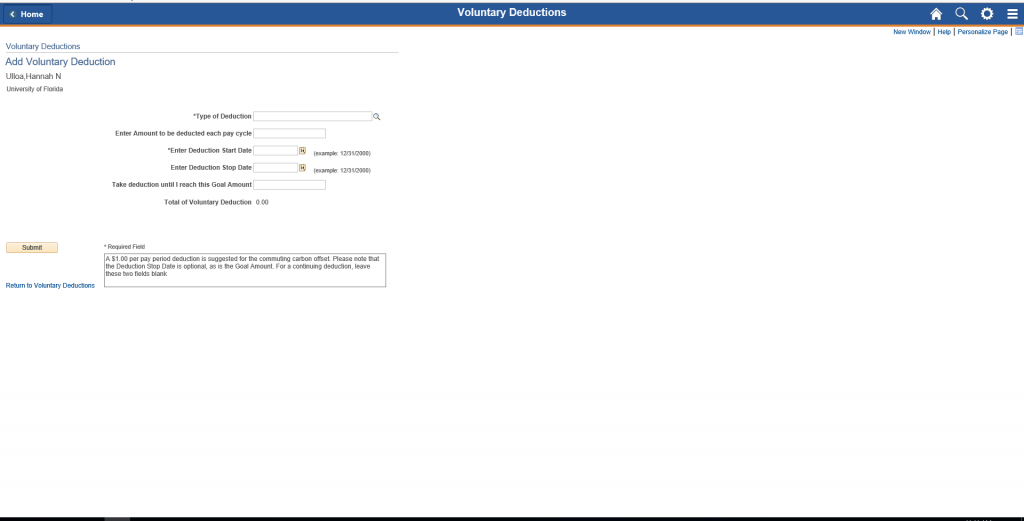

Step 4: Fill out the deduction enrollment form

- “Type of Deduction”: click the down arrow and select “Commuting Emissions Mitigation”

- “Enter Amount to be deducted each pay cycle”: choose the dollar amount from each pay check that you would like to be applied toward the emissions mitigation. $1.00 per pay check ($26/year) completely offsets the average UF employee’s commute. You may choose to apply more or less toward the carbon offset – there is no upper or lower limit.

- “Enter Deduction Start Date”: click the little calendar icon to the right of the text box and select the date on which you would like the deduction to start. The deduction will be applied to the paycheck following the date you choose. If you would like the deduction to start immediately, click “Current Date” at the bottom of the calendar.

- “Enter Deduction Stop Date”: leave this blank if you would like the deduction to continue to continue indefinitely (you can manually stop the deduction at any time). If you would like to enroll in the deduction for only 9 months or 12 months, choose a stop date that corresponds to that time period (you can manually start the deduction again at any time).

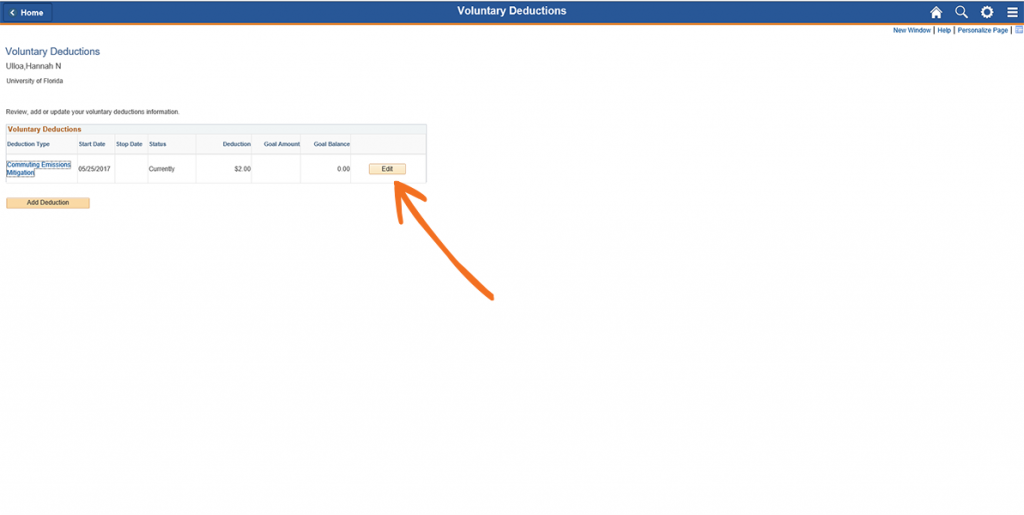

Step 5a: Modifying the deduction

- Once you have enrolled in the Voluntary Commuting Emissions Mitigation deduction, you can modify or stop it at any time.

- Simply navigate to the Voluntary Deductions page you visited to enroll (Main Menu –> My Self Service –> Payroll and Compensation –> Voluntary Deductions), and click the yellow “Edit” button to the right of the Commuting Emissions Mitigation deduction

Step 5b: Modifying the deduction

- From this page, you can change or stop the deduction

- To change the amount that is deducted each pay cycle, simply type a new amount in the “Enter Amount to be deducted each pay cycle” box and click the yellow “Submit” button

- To stop the deduction, simply click on the calendar icon next to “Enter Deduction Stop Date,” select the date on which you would like the deduction to stop, and click the yellow “Submit” button. The deduction will stop with the first pay check following after the date you chose.